Inventory valuation is the total worth of unsold inventories over a specified period of time. If a business does improper valuation, then it adversely affects financial reporting. It can even lead to poor purchasing decisions.

Inventory is an integral part of the business, as it directly affects cash flow and purchasing decisions. Research shows that inventories of retail, FMCG, and manufacturing companies account for 70% of total business assets. So, a slight error in inventory valuation can create significant financial issues.

What Is Inventory Valuation?

Inventory valuation is the process of determining the monetary value of unsold goods in a warehouse facility. There are various ways a business can calculate inventory valuation, such as FIFO, the weighted-average method, and others. The value reflects the Company's actual financial position. Inventory valuation is even necessary for tax reporting, audits, and compliance.

Here is a list of three terms that affect a business's inventory valuation.

- Cost of Goods Sold: If a business's ending inventory is higher, fewer costs are included in COGS, and the profit will look higher. Again, if the ending inventory is lower, more costs are added to COGS, and the profit will look low. So the inventory valuation directly affects the business's profit calculation.

- Multiple Period: If the business uses an incorrect inventory valuation, the reported profit can adversely affect the valuation of multiple periods.

- Income Tax: Businesses can reduce the income tax they pay each year by choosing the right inventory valuation method.

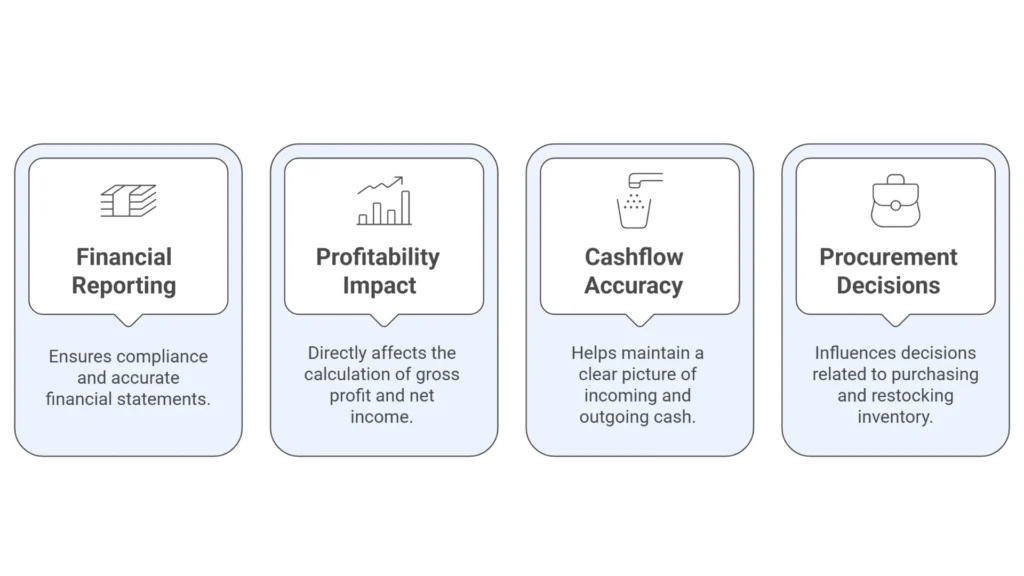

Why is Inventory Valuation Important For Business?

Inventory evaluation is highly essential for a business because of the following reasons.

1. Financial Reporting And Compliance

Inventory value has a direct impact on the business's balance sheet and income statement. For example, if we talk about the balance sheet, then the business needs to mention the beginning and ending inventory. Incorrect values can lead to errors in tax filing or audits.

2. Directs Affects Profitability

The profit may look higher or lower if the business does not do inventory valuation properly. It can lead to poor purchasing decisions.

Proper valuation calculates the actual money spent on producing goods. It helps in determining the actual profit of the business.

3. Maintain Accurate Cashflow

Inventory valuation helps a business to know exactly how much money is tied up in stock. It evaluates how much cash is available for salaries or daily purchases. Wrong valuation can lead to overspending or missed sales opportunities.

4. Influences Procurement And Reordering Decisions

Proper Inventory valuation helps a business identify slow-moving or obsolete items. Businesses can then adopt appropriate strategies to reduce waste or determine the optimal time and quantities to reorder products.

Key Components Of Inventory Valuation

- Purchase Cost: It is the price the business pays to the seller for purchasing products.

- Conversion/Processing Costs: These are the costs associated with converting raw materials into finished goods. It includes workers' wages, machinery, electricity, and any other expenses necessary to convert raw materials into a product ready for sale.

- Freight, Transportation & Handling Charges: These are the costs associated with moving goods from the supplier or manufacturing company to the warehouse. It includes costs associated with loading and unloading goods, shipping, and handling fees.

- Duties And Taxes: If the business imports goods, then customs duties and taxes must be added to the inventory costs.

- Storage & Administrative Costs: These costs cover the expenses of storing and managing inventory in the warehouse facility.

- Discounts And Rebates: These costs include trade discounts or discounts on purchasing bulk products.

Inventory Valuation Methods

There are various inventory valuation methods. Some of them are in the list below.

1. FIFO (Fast In Fast Out)

It is an inventory valuation method in which the oldest items are sold out of the warehouse first.

For example, a business buys 10 units at Rs 100 each and then buys another 10 units at Rs 120 each.

The business first sells 10 units to the customer. So COGS here is Rs1000. The ending inventory is Rs 1200.

Pros

- Simple and easy to manage.

- Essential for perishable products.

Cons

- It can lead to high taxable income.

2. LIFO (Last In First Out)

It is an inventory valuation method in which the inventories brought in last are sold out first from the warehouse.

Let's discuss with an example. A business buys 10 units at Rs 100 each and then buys another 10 units at Rs 120 each.

So, according to LIFO, the business sells 10 units at Rs 120 each. So COGS is RS1200.

Here, the ending inventory is Rs 1000.

Pros

- Higher COGS results in a reduction of taxable income.

Cons

- Initial inventory can become outdated with time.

3. Weighted Average Cost

A business usually uses the weighted-average method when all inventories are identical.

WAC = Total cost of all units ✖ Total units available

Let's discuss with an example. If a business buys 10 units at Rs100 each and another 10 units at Rs 120 each, then WAC = 1000 + 120020 = Rs 110 per unit

If the business sells eight units, then COGS = 110 ✖ 8 = Rs 880

Here ending inventory = 110 ✖12 = Rs 1320

Pros

- Date of purchase does not matter.

- It works well for similar inventory.

Cons

- Not effective for highly valuable products.

4. Specific Identification Method

Business utilizes this method when every item of inventory is unique. It is common for cars, jewellery, artwork, electronics and many more.

For example, a business has watch A of Rs 20,000, watch B of Rs 35,000 and watch C of Rs 50,000.

If the business sells watch B for Rs 35,000, then the ending inventory is Rs 70,000.

Pros

- Reduces risk of loss or theft.

Cons

- Detailed tracking of each product is necessary.

How Inventory Valuation Affects Cost Of Goods Sold?

COGS = Opening inventory + purchases - Ending inventory

If the ending inventory is high, then the COGS is low.

If the ending inventory is low, then the COGS is high.

How To Choose The Right Inventory Valuation Method For Your Business?

A business needs to consider various factors when choosing the right inventory valuation method. The factors are in the list below.

1. Consider Product Type

A business needs to consider the product type while choosing the type of inventory valuation method. For example, if the business deals with perishable or pharmaceutical products, then it should choose the FIFO method. Again, if the business has all the identical methods, then it should choose the weighted average method. The business needs to choose a specific identification method if it deals with valuable products like cars or jewelry.

2. Analyze Profitability Goals

Profitability goals are also a factor when considering the type of inventory valuation. For example, if a business has a goal of achieving immediate profit, then it should adopt the FIFO method. It results in lower COGS and high net income. Again, if a business wants low tax liability, then it should follow the LIFO method.

3. Track Market Price Fluctuations

A business can track market price fluctuations and adopt the inventory valuation method. For example, if a business deals with products whose prices rise over time, it should adopt the FIFO method, as it will yield lower COGS and higher profit.

4. Understand Accounting Compliance

A business should follow an inventory valuation method that complies with Indian accounting rules. For example, the LIFO method is not allowed in India. So businesses should adopt such a method.

Best Practices For Accurate And Smart Inventory Valuation

A business should adopt a few practices to ensure accurate, smart inventory valuation. Here is a list of them below.

- Conduct Regular Physical Audits: A business needs to do regular physical inventory audits to evaluate damaged or missing items in the warehouse.

- Use Real-Time Inventory Tracking: A business can use advanced software, such as a warehouse and inventory management system, to track products in real time and avoid stockout and understock issues.

- Standardize Receiving And Storage SOPs: A business should have a transparent process for receiving, checking, labelling, and storing inventory. It keeps the inventories organized in the warehouse.

- Integrate Accounting And Inventory Systems: A business can use advanced software that can integrate accounting and inventory systems and avoid mismatched data or incorrect COGS calculation.

Conclusion

Inventory valuation is a process that shapes a business's financial health. A D2C or ecommerce company in India needs to do proper valuation to make smart decisions and long-term growth in this competitive world. The business needs to choose the right method and track inventories in real time to improve its profitability.