Poor inventory management costs businesses more than $1 trillion annually due to issues of overstocking or understocking. Small business owners can face numerous challenges in growing and generating less profit due to improper inventory management.

This is where the role of inventory accounting comes in. It not only tracks inventories in real-time but also records their purchasing value and sales value. This helps maintain accurate stock records and avoid problems with stock issues. Businesses can make informed decisions based on reports generated through inventory accounting software.

What Is Inventory Accounting?

Inventory accounting involves keeping a record of all the inventories that a business purchases, sells, and that remain in the warehouse. If a business sells some of its inventory, it should record the sale as an expense or cost of goods sold (COGS). It records the remaining stock as an asset.

Let's discuss with an example. A Company buys nine bags at Rs500. It sold five bags at Rs800 each. So, the cost of goods sold is Rs 4000. Therefore, the business records a profit of Rs 1500.

4 bags that are now remaining in the Company. The value of the stock remaining is Rs 2000.

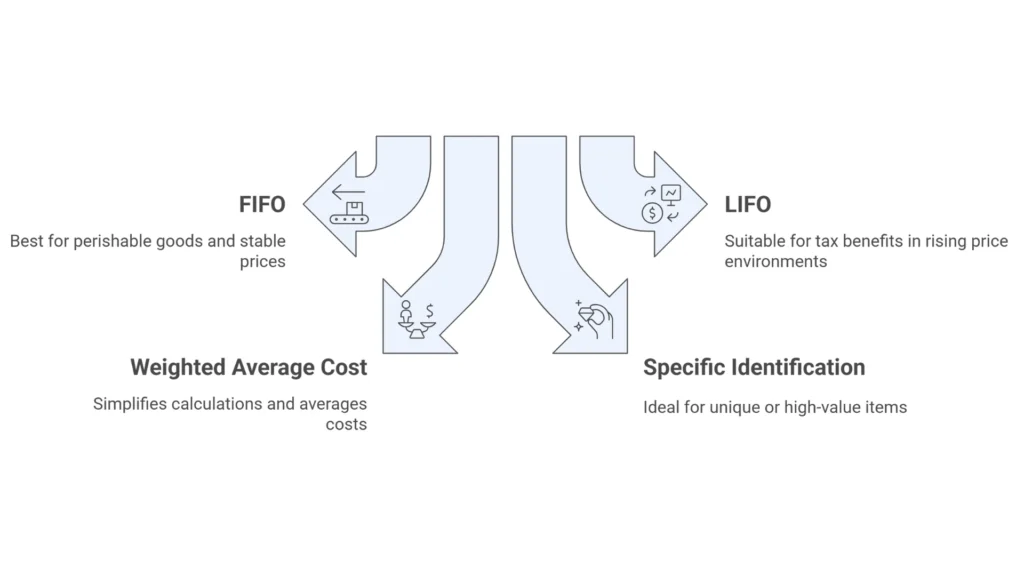

There are various inventory accounting methods, such as FIFO and LIFO, among others. A Company should carefully choose the inventory method based on its business model, as it will impact its profitability.

A business adds inventories, sells the existing ones to customers, and removes the obsolete ones from fulfillment centers. Hence, today, most businesses use an advanced tracking system for inventory accounting. It makes it easier to update the changes with the inventories.

Importance Of Inventory Accounting For Small Businesses

- A small business faces challenges while keeping track of the stock available in the 3PL warehouse and its monetary value. If the stock is excessively stored in the warehouse, it will increase the business's storage costs and insurance expenses. It can adversely impact the business's cash flow. Again, if there is too little inventory, then it leads to missed sales opportunities and dissatisfied customers.

- Inventory accounting maintains a record of all the stock that a business sells to customers, as well as that which remains unsold. This helps avoid problems such as overstocking and understocking issues in a business.

- Proper inventory records can help a business easily claim tax and avoid legal penalties.

- Inventory accounting even allows a business to review which items are in high demand among customers.

Different Types Of Inventory Accounting Methods You Should Know

There are various types of inventory accounting methods. Here is a list of them below.

1. FIFO (Fast In First Out)

It is a method in which the items that were purchased first by a business are sold out first. The business should use the oldest inventory available in the warehouse to first fulfill customer orders.

Let's discuss with an example. The companies that sell perishable goods get the most advantage of the FIFO method. If a business keeps perishable goods for a longer period, they can deteriorate, and the Company must discard them. The FIFO method ensures that the customers get fresh products.

2. LIFO (LAST IN, FIRST OUT)

Here, the business sells out first the inventories that it purchased recently. This method works best for nonperishable goods or products which have less risk of obsolescence. However, LIFO can increase the cost of goods sold and reduce the net profit of the business.

3. Weighted Average Cost

The weighted average cost per unit of the product is equal to the ratio of the total cost of goods available to the total units available.

Let's discuss with an example:

A retailer buys 50 bottles at Rs 10 each. So it costs the retailer Rs 500.

The same retailer buys another 50 bottles a few days later at Rs 20 each. It costs the retailer Rs 1000

Therefore, the retailer must spend a total of Rs 1,500 for 100 bottles.

Weighted average cost = 1500100 = Rs15 per bottle.

4. Specific Identification Method

Here, the business tracks the actual purchase cost of each inventory item and records it. It also records the cost of goods sold for each inventory item in the warehouse. This method is an accurate inventory accounting method suitable for jewelry, luxury items, watches, and a wide range of other items.

How To Do Inventory Accounting?

Here is a step-by-step procedure for inventory accounting.

- Record Purchases and Receipts: Whenever a business buys any products or raw materials, it should record its quantity, price, and date.

- Track Sales and Inventory Movement: The business should maintain a record of the inventory sold from the warehouse. It should keep a record of their selling value.

- Apply Valuation Method: The business should select the inventory accounting method that best suits its model. The methods are of various types, including FIFO, LIFO, weighted average, and specific identification method.

- Calculate COGS: The business should calculate the cost of goods sold. It shows the expenditure of items sold during a particular period.

- Reconcile Records With Physical Stock Counts: The business staff should conduct physical counts and verify that the records match the physical counts. The staff then adjusts the records if there are any shortages of inventory in the warehouse storage.

- Generate Financial Reports: The business should then prepare reports, such as the income statement and the balance sheet. These reports will help in making decisions and claiming tax.

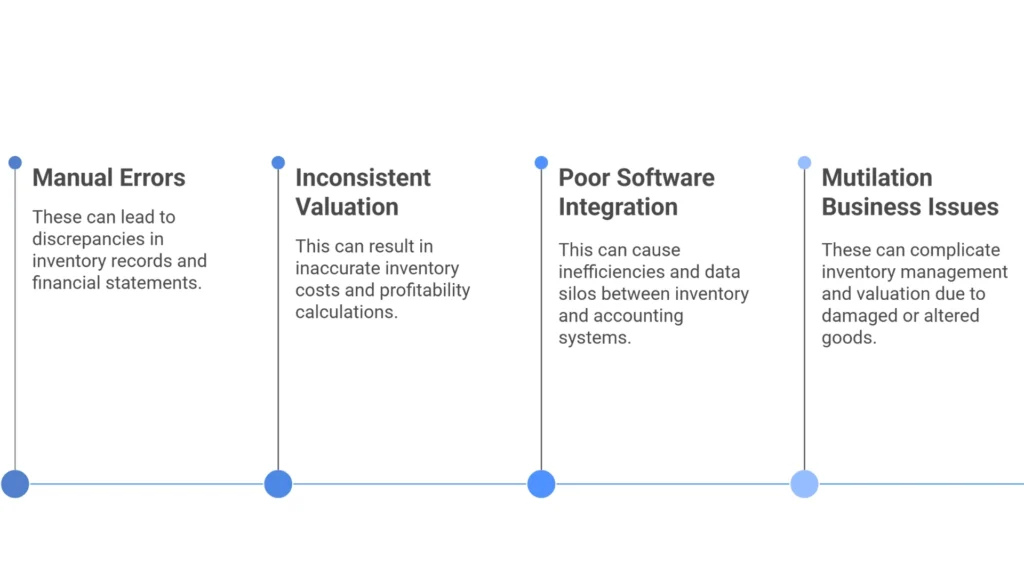

Common Challenges In Inventory Accounting

Inventory accounting presents a few challenges. Here is a list of them below.

- Manual Errors In Tracking: When a business records data manually, it can have duplicates or incorrect entries in the sheet. A small error can result in a significant difference in profit.

- Inconsistent Valuation Methods: If a business repeatedly switches inventory accounting methods within a particular period, it can lead to errors in the report.

- Poor Integration With the Accounting Software: If the business does not effectively connect its inventory systems with the accounting software, it can lead to errors in the report.

- Issues In the Mutilation Business: If a business has multiple warehouses, then it faces challenges in maintaining stock records.

Best Practices For Small Business Inventory Accounting

- Cloud inventory systems accurately track products in real-time, even if the business has warehouses in various locations.

- A business can perform manual counting to ensure it matches the records, cycle counting, and detecting errors without closing down various supply chain operations.

- The staff who handles inventory should be familiar with FIFO, LIFO, and other inventory accounting methods.

Tools And Software For Inventory Accounting

1. Zoho

It is a cloud-based inventory accounting software that updates stock levels in real-time, avoiding problems of overstocking and understocking. The stock notifies the business when the inventory falls below the reorder level. The software generates reports on how many inventories are sold out and how many remain in the warehouse.

2. Xero

Xero is the following best cloud-based inventory accounting software, automatically generating reports on which items are sold out to customers and which stock is less in demand in the warehouse facility. This accounting software is best for small business owners. The basic version of Xero is simple and lacks a few advanced features, such as tracking of expired items.

3. QuickBooks

QuickBooks updates about the inventories in real time. The business can set a level for each inventory, and QuickBooks updates when the inventory falls below that level. However, this software has a few limitations, including the need for third-party software for barcode scanning.QuickBooks cannot update stock availability properly if the business has many warehouses.

Advanced Inventory Management Systems

As a small business begins to grow, inventory management software like QuickBooks and Zoho may not be sufficient for its needs. Businesses need to utilize advanced inventory management systems, such as the following.

1. EasyEcom

EasyEcom is a cloud-based inventory platform that generates real-time reports and updates on the stock levels of multiple warehouses.

2. NetSuite

NetSuite is a powerful ERP system that supports businesses with global operations.

3. SAP Business One

SAP Business One is an ERP solution that enables batch tracking and real-time updates on stock levels across various warehouse locations.

Final Words

Inventory accounting plays a vital role in the success of any business. It maintains stock records and prevents out-of-stock issues. It ensures accurate records and improves the business's cash flow. However, a business needs to choose the proper inventory method for managing inventory and make smarter decisions.