Inventory valuation is the process of calculating the total value of the goods a business has in stock at a given time. In this process, businesses find out how much their stock is worth.

Inventory valuation is the cornerstone of business performance. It determines the monetary value of the unsold inventories in the stock. A business can do proper inventory valuation by methods like LIFO and FIFO, and ensure that the valuation is never overstated or understated.

What Is Inventory Valuation?

Inventory valuation is a process of determining the cost of the unsold stock in the warehouse and recording it in the business's financial statement. Businesses need to do inventory valuation to determine the inventory turnover ratio. A higher ratio will indicate that the inventories are sold quickly to the customers. However, if the inventory ratio is low, it shows the problems of overstocking inventories in the warehouse facility.

Importance Of Inventory Valuation

1. Accurate Financial Reporting And Compliance

Inventory is the primary asset in the business balance sheet. The monetary value of the unsold inventories in the warehouse at the end of the year will reflect the Company's actual financial position.

Accurate inventory valuation is essential for producing reliable financial statements and ensuring adherence to accounting standards like GAAP and IFRS.

2. Calculating the cost of goods sold and profit margins

Inventory valuation helps calculate the cost of goods sold in the business.

Cost of goods sold (COGS) = (Opening Inventory + purchases) - Closing Inventory

If the closing inventory is lower, the cost of goods sold (COGS) is higher. It indicates lower profit for the business.

Simultaneously, if the closing inventories are higher, the cost of goods sold is lower. It indicates a higher gross profit for the business.

3. Optimizes Business Decisions

Accurate Inventory valuation helps businesses to make wise decisions in purchasing, procurement, and production.

Let's discuss with an example. A business with a record of Rs 1000 items in stock can delay its order and prevent unnecessary purchases.

4. Avoiding Under Or Overstatement of Assets

As discussed earlier, businesses must correctly present the inventory valuation in their financial statements to make wise decisions. However, if it is overstated, the business's total assets and profit will appear higher than their actual value and mislead the Company's stakeholders.

Simultaneously, if it is understated, then the business's profit will appear lower, adversely affecting the Company's financial reputation.

5. Tax Implications

Inventory valuation even directly affects the business's tax liability. For example, if the closed inventory is understated, the COGS will be higher than the actual. It reduces the taxable income of the business. However, it is beneficial only for a short period. The Company has to pay penalties for it.

If the closed inventory is overstated, the COGS will be lower than the actual. It can increase the taxable income of the business.

So inventory control, i.e, the actual monetary value of closed inventory, is essential for fair tax reporting and avoiding penalties or higher taxes.

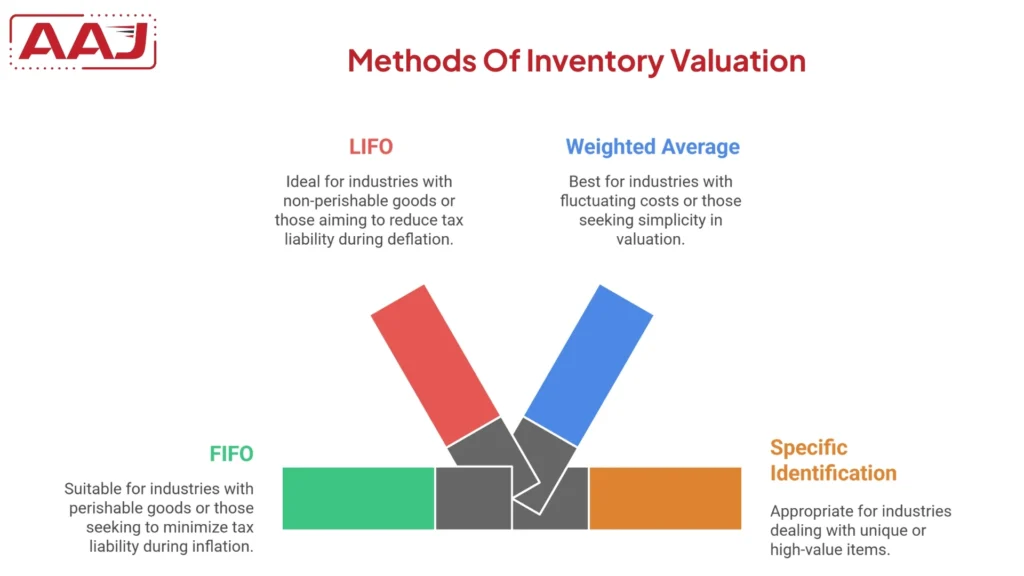

Methods Of Inventory Valuation

A business can do inventory valuation in various ways.

1. FIFO (Fast In First Out)

Here, the oldest inventories from the warehouse are sold out first to the customers. The new stock remains in the warehouse.

The FIFO method is best suited for perishable products or time-sensitive products.

2. LIFO (Last In First Out)

In the LIFO process, the new inventories from the warehouse are sold out first to the customers.

3. Weighted Average Method

It averages the cost of all inventory items. This method is best suited for dealing with homogeneous products.

Average Cost Per Unit = Total Cost of Inventory/Total units

4. Specific Identification Method

This method tracks each of the inventories from purchase to sale.

Objectives Of Inventory Valuation

The objectives of inventory valuation are as follows.

- Accurate valuation represents the actual financial position of the Company.

- Proper valuation determines the cost of goods sold by a business.

- A business needs to do valuation based on the accounting standards. Correct valuation complies with tax laws and avoids penalties.

- Proper valuation allows stakeholders to evaluate profitability across periods and make informed decisions.

Factors Affecting Inventory Valuation

Various factors affect inventory valuation. Here is a list of them below.

1. Inventory Holding Time And Shelf Time

If a business stores perishable products or time-sensitive products like pharmaceuticals for a longer time in a warehouse, it loses its monetary value.

2. Freight-In And Other Procurement Costs

The inventory cost includes shipping charges, customs duties, and handling charges. If the freight charge increases because of the rise in fuel price, then the cost of the unsold inventories also rises.

3. Write-Offs, Damages, Or Obsolescence

Unsold damaged or outdated inventories lose their monetary value. The Company needs to reduce its costs to sell it in the market.

4. Market Price Fluctuations

The cost of the unsold inventories changes with the change in demand in the market, economic conditions, and seasonal trends.

Challenges In Stock Valuation

There are a few challenges during the stock valuation. Here is a list of them below.

1. Handling Mixed Inventory

When a business purchases goods at various rates, it becomes challenging for the business to decide the monetary value of the unsold inventory in the warehouse.

2. Managing Frequent Price Fluctuations

The cost of a product changes with the change in geographical events, inflation, and currency exchange rates, ultimately making inventory valuation challenging.

3. Technology Reliance And Need For Accurate Records

Inventory valuation depends on accurate data from the software. Any incorrect entry caused by scanning can mislead the valuation.

Final Words

Accurate inventory valuation is necessary for a business to stay competitive in the market. It represents the actual financial position of the Company and reduces taxes or avoids penalties. Businesses can even make informed decisions because of proper stock valuation.