Ending inventory also known as ending stock is an indicator of a business's financial health, representing the monetary value of unsold products remaining in the warehouse.

There are various ways to calculate ending inventory value, such as FIFO and the specific identification method. A business can choose the right method and calculate the ending stock value at the end of the accounting period.

What Is Ending Inventory?

Ending inventory refers to the total value of unsold goods in the warehouse at the end of the accounting period. It typically involves three types of inventory: raw materials, work-in-progress, and finished goods.

If a business reports a higher ending stock, it indicates a lower cost of goods sold during a particular accounting period. The company has to pay higher taxes due to a high ending stock.

Similarly, if the business has a lower ending inventory, then the cost of goods sold during a particular accounting period is higher. The company has a lower gross profit due to low ending stock.

Ending inventory = Beginning inventory + purchase - COGS

Beginning inventory is the inventory cost at the start of the accounting period.

Purchase includes the cost of inventories that the business purchases during the accounting period.

COGS is the cost of goods sold during the entire accounting period.

Let us discuss with an example.

A business has a beginning inventory worth Rs 80,000

The business has purchased inventories worth Rs 40,000

Cost of goods sold is worth Rs 75,000

So here the ending inventory = 80,000 + 40,000 - 75000 = Rs 45,000

Importance Of Ending Inventory

- Ending inventory provides a clear picture of a company's current assets at the end of the accounting period.

- Ending stock directly affects the business's balance sheet. It provides a clear view of the business's financial performance.

- A business can identify turnover and measure gross margin by properly calculating ending stock.

- Accurate ending inventory calculation can help a business to reorder stock appropriately. It even avoids overstocking and understocking issues in a business.

Methods To Calculate Ending Inventory

There are various methods to calculate ending inventory. Some of them are listed below.

1. First In First Out (FIFO)

FIFO assumes that the business should sell the oldest inventory from the warehouse first. The new inventories remain in the warehouse and become the ending stock. It is best for businesses dealing with perishable or pharmaceutical products. However, during a period of inflation, this method can lead to higher taxes.

2. Last In First Out (LIFO)

The LIFO principle states that the first items purchased are sold out of the warehouse first. The old inventories here become the ending inventory. A business that aims to reduce tax liabilities, especially during an inflationary period, can follow this principle. However, it has a few limitations, including the potential to mislead investors.

3. Weighted Average Cost

Weighted average cost is the ratio of the total cost of goods available to the total units available. Businesses that deal with identical products should follow this method. Weighted average cost is simple and easy to apply. However, this method is not suitable for highly valuable products.

4. Specific Identification Method

A specific identification method tracks and records the actual cost of each product separately. This method is highly accurate and well-suited for businesses dealing with high-value or unique products. However, businesses may find it challenging to apply this method to high-volume inventory.

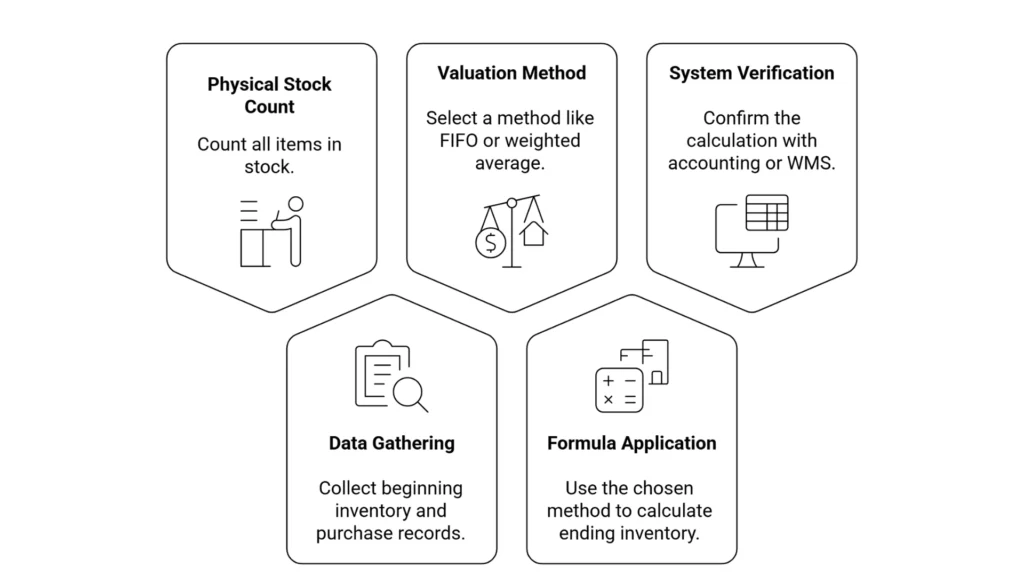

How To Calculate Ending Inventory Step By Step?

Here is a step-by-step method for calculating ending inventory.

1. Conduct A Physical Stock Count

The business should conduct a physical count of all the products in the warehouse storage. It should record all the quantities accurately without any estimation.

2. Gather Beginning Inventory And Purchase Data

Beginning Inventory: The business should calculate the value of stock on hand at the beginning of a particular accounting period.

Purchases: The business should calculate all costs associated with purchasing inventory during a particular accounting period. It includes handling and freight charges associated with purchasing products.

The business can then calculate the cost of goods available for sale(COGAS).

COGAS = Beginning inventory + purchases

3. Choose An Inventory Valuation Method

The business can choose an inventory valuation method for calculating ending inventory. There are various methods to calculate ending stock, such as the first-in, first-out (FIFO) method, the last-in, first-out (LIFO) method, the specific identification method, and the weighted average cost method. Each method has its pros and cons. The business should weigh the pros and cons and then choose the method.

4. Apply The Ending Inventory Formula

Ending inventory formula = Beginning inventory + purchases - COGS

COGS is the cost of goods available for sale.

5. Verify With Your Accounting Or WMS System

The business should manually calculate the ending inventory value and match the results with digital systems, such as warehouse and inventory management platforms. Verification ensures accurate reporting with the accounting or WMS system.

Common Mistakes Small Businesses Make While Calculating Ending Stock

There are a few mistakes which small businesses make while calculating ending stock.

- Relying Entirely On Manual Records: Many small business owners track inventories using spreadsheets. These methods often lead to data entry errors and inaccurate stock balances.

- Ignoring Damaged, Expired, Or Slow-moving Stock: If a business ignores damaged, expired, or slow-moving stock and includes it in the ending stock, it leads to inaccurate profit calculations.

- Incorrect COGS Calculation: Many businesses do not include transportation or freight costs when calculating the cost of goods sold. That leads to an inaccurate ending stock value and adversely affects the business's tax statement and audit.

- No Regular Cycle Counting: Many businesses do not conduct regular physical cycle counting, which leads to an incorrect ending stock value.

- Using Wrong Inventory Valuation Method: If a business deals with unique or valuable products and chooses the weighted-average cost method instead of the specific identification method, it results in an incorrect ending stock value.

How Accurate Ending Stock Supports Supply Chain Efficiency?

- Accurate ending inventory ensures that purchasing decisions are based on actual warehouse stock availability. It even tracks fast-moving products effectively. Businesses can make important decisions wisely.

- Accurate ending stock enables faster order fulfillment operations and helps avoid overstocking and understocking.

- Accurate calculation of the ending stock value enables accurate demand forecasting. Thus, the business can accurately plan product reorders.

Final Words

Many businesses perform physical stock counts at the end of the accounting period and miscalculate their ending inventory. This can lead to poor decisions and create overstocking and understocking issues. Businesses even have to pay more taxes due to incorrect ending stock calculations.

So, ending inventory is a strategic tool that directly affects a business's overall supply chain. A business needs to perform physical stock counts from time to time, choose an appropriate method, and calculate ending stock.